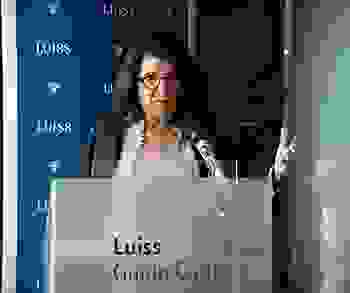

A thought-provoking debate in Milan Luiss University hub, centering around the crucial topic of tax reform. The event 'the penalty system in tax reform', organized by Paola Severino, Vice President of Luiss University, gathered a distinguished panel of government officials and tax experts to discuss the potential replacement of traditional penalty systems with a cooperative approach between citizens and the Revenue Agency.

The proposed enabling act for tax reform aims to simplify administrative sanctions, mitigating conflicts with criminal sanctions and upholding the 'ne bis in idem' principle. The primary objective is to foster compliance with tax obligations through a cooperative relationship with the tax agency, known as 'cooperative compliance,' offering a viable alternative to the conventional penalty system.

The debate featured the insights of various experts, including Minister of Justice Carlo Nordio, Deputy Minister of Economy and Finance Maurizio Leo, and Milan Prosecutor Marcello Viola. These distinguished speakers shared diverse perspectives on the tax penalty system, delving into a comparative analysis of punitive methods concerning both individuals and entities.

Tax sanctions serve a vital role in promoting adherence to tax laws and combating tax evasion. However, it is imperative to ensure that such sanctions are applied equitably, proportionately, and effectively in order to maintain the integrity of the tax system. Achieving this goal necessitates close collaboration between tax authorities, judicial institutions, and law enforcement agencies.

One of the notable speakers at the event was Professor Livia Salvini, an esteemed expert in Tax Law at Luiss University. Professor Salvini elaborated on the concept of the Collaborative Compliance Scheme, which entails taxpayers cooperating with tax authorities to identify errors or violations and negotiating agreements to rectify their situations. Guglielmo Maisto, former Professor of International and Comparative Tax Law at the Università Cattolica del Sacro Cuore in Piacenza, provided valuable insights by examining comparative perspectives to understand the disparities between administrative and criminal tax penalty models.

In her concluding remarks, Paola Severino shed light on the issue of entity liability, an approach aimed at combatting tax evasion and tax avoidance, particularly when such violations are advantageous to the company. Severino emphasized the importance of encouraging entities to implement internal control and tax compliance measures, holding their representatives and employees accountable in order to prevent violations.

Minister of Justice Carlo Nordio summarized the key takeaways from the day's discussions, emphasizing the paramount significance of tax justice reform as a critical priority for Italy. The insights and ideas shared during this engaging debate serve as a foundation for potential future reforms in the country's tax system.

Attachments

- Italian Deputy Minister of Economy and Finance Maurizio Leo

- Italian Minister of Justice, Carlo Nordio

- panel 'the penalty system in tax reform'

- Paola Severino, Vice President of Rome's Luiss University